Product Feature Focus: February 2024

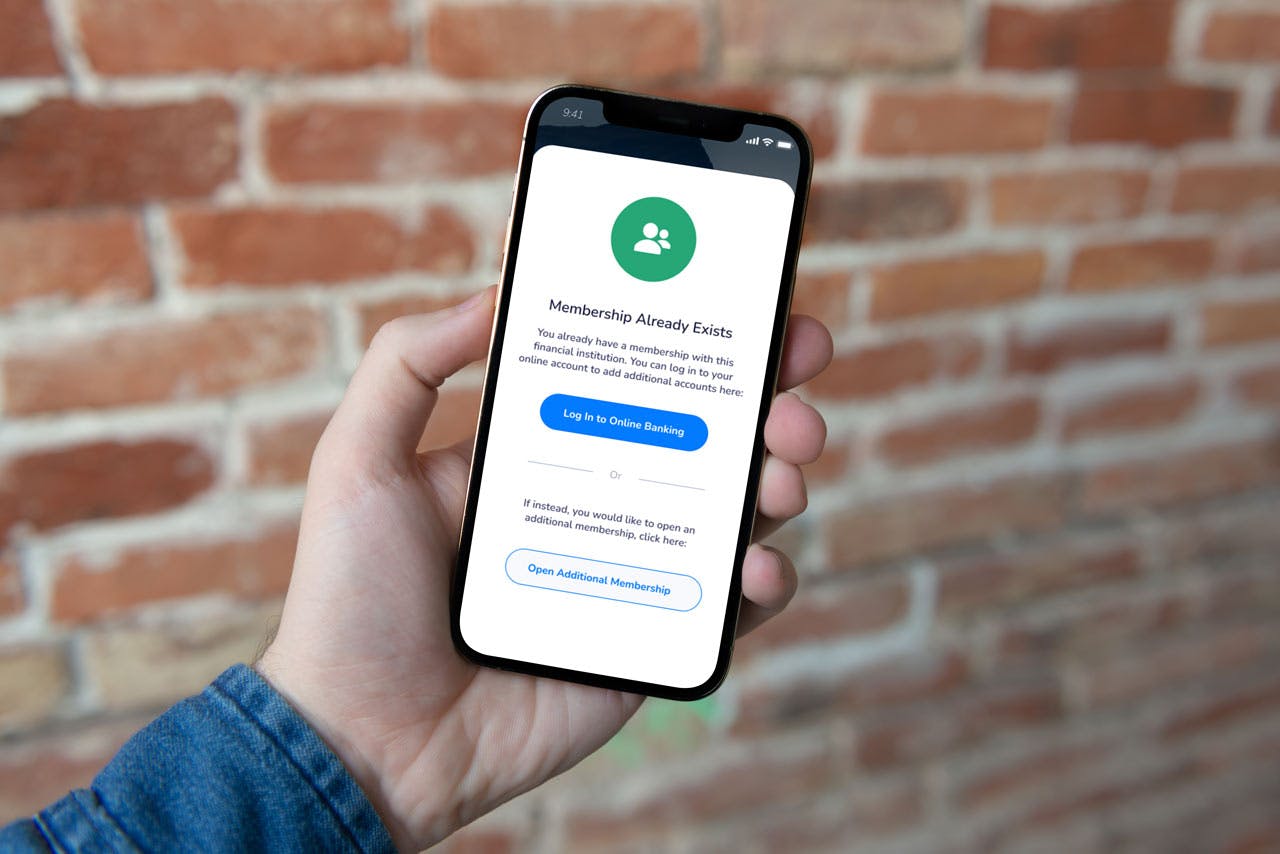

Introducing Membership Features in OAO Designed Exclusively for Credit Unions

Bankjoy's latest update to the Online Account Opening (OAO) feature now allows your credit union's members to add additional primary accounts or memberships under a single login, streamlining their banking experience and fostering deeper engagement with your credit union.

- Enhanced User Experience: One login, multiple memberships to ease account management

- Fully Integrated with your core: Compatible with all core banking systems

- Activation Made Easy: Contact Bankjoy Tech Support and roll out this new feature to your members fast

Simplify Account Access with Username Retrieval

We recently introduced a user-empowering feature: Username Retrieval. Banking hours no longer bound your members. With Username Retrieval, they can effortlessly regain access to their accounts anytime:

- Self-Service Convenience: Users can quickly and easily securely retrieve their usernames by providing their email, account number, and the last 4 digits of their SSN.

- Secured Steps: Multi-Factor Authentication (MFA) ensures a secure retrieval process, backed by detailed logs for each attempt.

- Ready to Use: Activated by default to ensure immediate benefit, with the option to tailor the feature through Bankjoy Support.

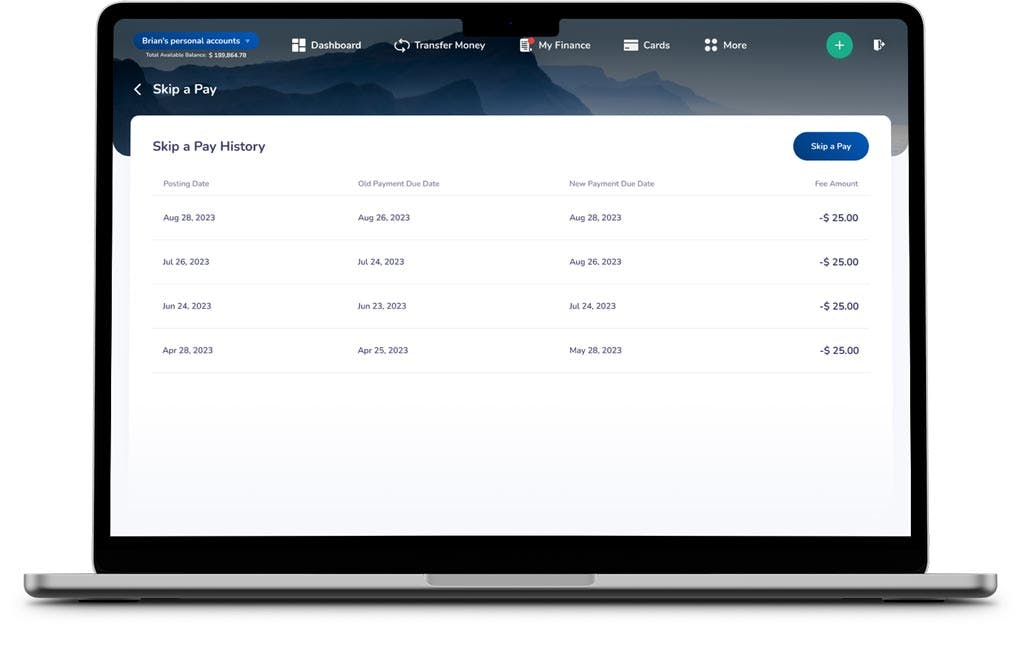

Introducing Payment Flexibility with 'Skip A Pay'

'Skip A Pay' is more than a feature; it's a lifeline for users during financially tight moments. Designed to seamlessly integrate with Corelation’s core, this feature allows users to defer a loan payment when they need it most:

- Automated Eligibility Checks: Instantly informs users of their ability to skip a payment, directly within their banking interface.

- Quick and Easy to Process: Collects a minimal fee from the member’s account to process the loan extension on the spot.

- Loan Extension History: Allows users to monitor their payment deferments, fostering transparency and trust in their financial journey.

Previous Article

Sneak peak of OAO's Deposit-Growth Features: Webinar ReplayNext Article

Product Feature Focus: April 2024