OAO 2.0 Continues to Rollout New Features

Regional banks and credit unions have rebounded nicely from the panic earlier this year when Silicon Valley Bank’s customers, along with many other small FIs, fled to larger institutions. To lure some of these depositors back and attract new ones, some FIs offered higher interest rates. In many cases, a streamlined, fully-online onboarding process was critical to driving new member account and deposit growth.

Since the relaunch earlier this year, Bankjoy’s Online Account Opening service, OAO 2.0, continues to offer more value to small and medium-sized FIs. Included below is a brief overview of a few notable features:

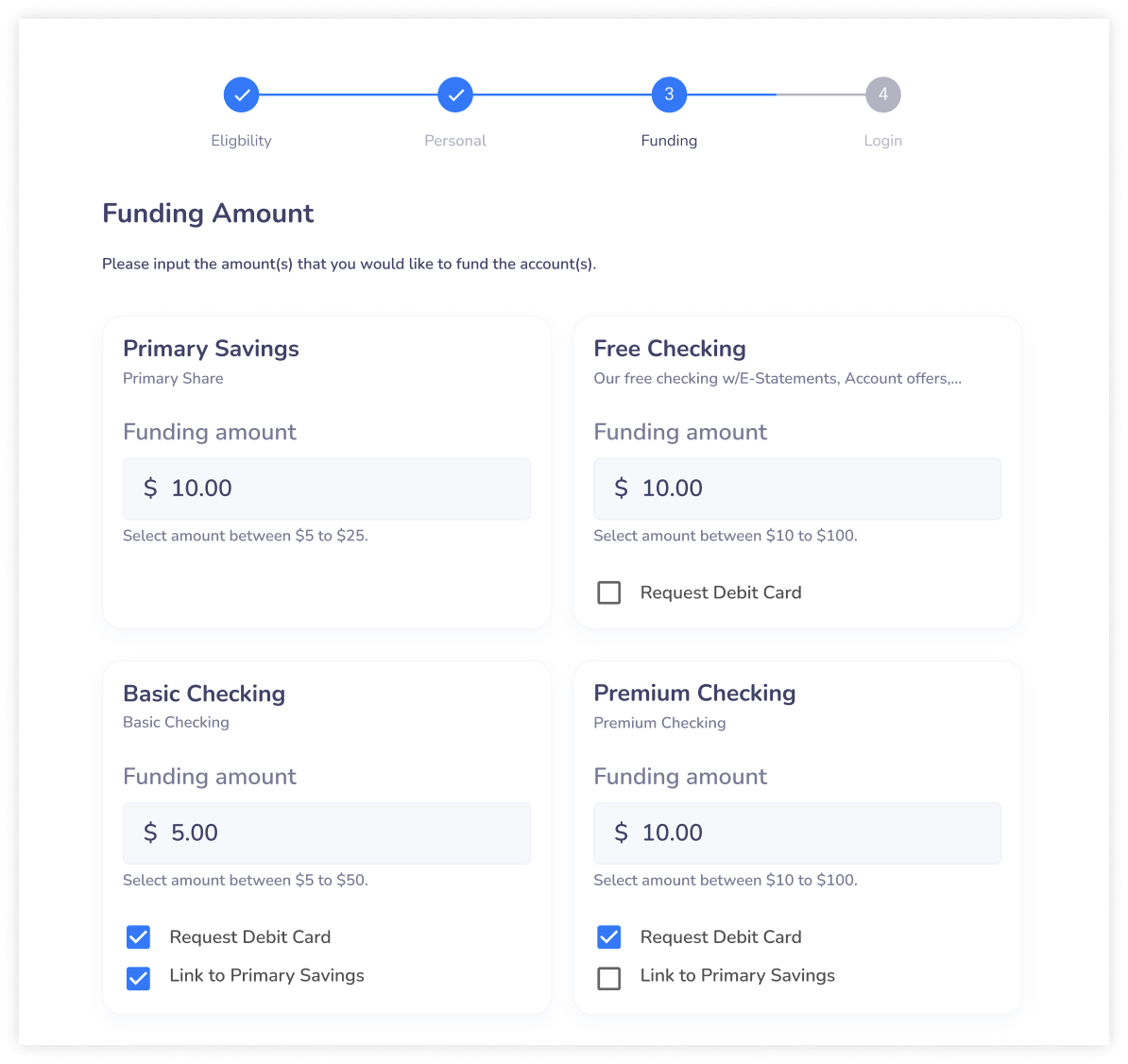

Open multiple accounts

We’ve added the ability to open additional products within a single account opening process. This will help FIs increase the number of accounts and shares opened.

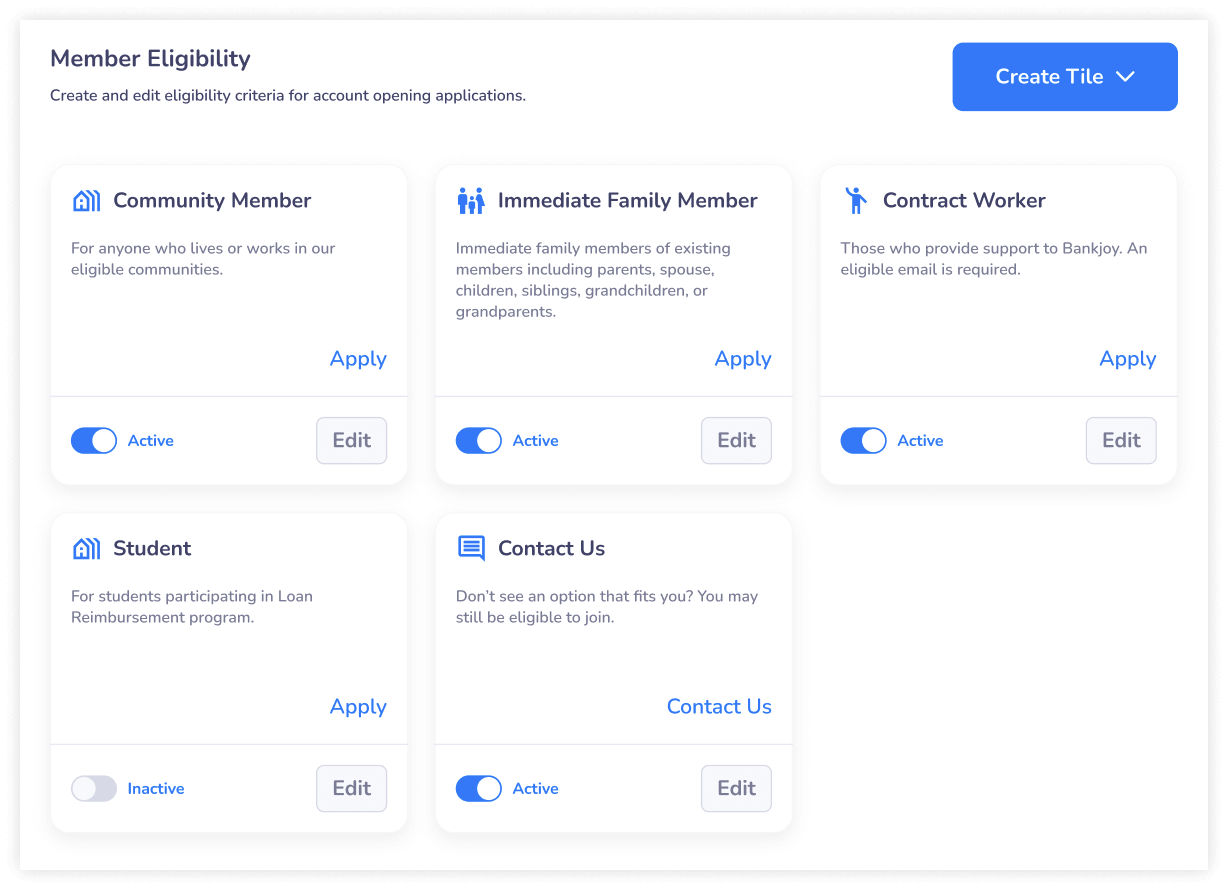

Manage membership eligibility in the client portal

This feature adds basic configuration capabilities into the Client Portal to enable easier client onboarding and eligibility modifications.

Schedule application emails to complete application process

Often, prospective member applications are left incomplete without an automated way to complete the onboard process. Now, FIs can design and implement scheduled emails targeted to prospective new account holders who abandoned the process before opening an account. These emails are designed to boost account creation rates.

Want to hear more? Contact your account executive or CSM to see OAO 2.0 in action!